Gold is not merely an exquisite metal in India or an investment option; it is regarded as the metal of gods and royalty, holding great sentimental value for the people here. India is the largest importer of gold in the world, contributing around 6-7% of the country’s GDP.

Indians buy gold throughout the year but their number grows during the festive and wedding seasons. It is considered auspicious to buy gold on Makar Sankranti, Gudi Padwa, Navratri, Dusshera, and Akshaya Tritiya. Yet, Dhanteras holds a special significance for buying gold and silver in our country.

Dhanteras or Dhanatrayodashi is an important Hindu religious festival, which is celebrated on the first day of the five-day Diwali festival. ‘Dhan’ signifies wealth and ‘teras’ means the thirteenth day of the month of Karthik, according to the Hindu calendar. The deities of wealth, Goddess Lakshmi and Lord Kuber are worshipped on this day. Purchasing gold or silver on this day or even other forms of ‘dhan’ is considered prosperous to keep evil and death at bay. This year Dhanteras commences on October 17.

According to the World Gold Council, gold demand in India witnessed a significant decline of about 21% in 2016, mainly due to challenges like jewellers’ strike, PAN card requirement for verification and the demonetisation move. However, the demand for gold again increased by 15 % during the first quarter of 2017, signalling a return of optimism in the industry.

Even in the second quarter of 2017-18, the demand for gold was at 167.4 tonnes, up by 37 % compared to overall Q2 demand of 122.1 tonnes for 2016. India’s gold demand in Q2 2017 stood at 167.4 tonnes, a robust quarter, as seasonal demand and improved rural sentiment contributed to the increase. Both jewellery and investment demand saw a healthy rise of 41% and 26%, respectively.

With the introduction of the Goods and Services Tax (GST), taxation on gold has risen to 3% from 1.2 % previously. The sector has witnessed a decrease in the footfalls initially. However, as the festive season approaches, the gold market is reviving significantly. The price of gold has reduced recently, and the demand has surged. Even the demand for silver has spiked.

Deepika Sabharwal Tewari, Associate Vice President – Marketing, Jewellery Division, Titan Company Limited, said, “The Dhanteras period sale is approximately 20% of our annual sale and we are looking at a 25% growth over last year. At Tanishq, we always keep the needs of our customers in mind and design our collections to suit their requirements.”

A spokesperson from Kolkata-based Anjali Jewellers told BE, “Indians have an unending appetite for gold and there is a sentimental as well as aspirational value attached to the yellow metal. Gold prices, as of now, are moderate. Even if the prices are high, Indians find the festive season auspicious to purchase gold. We are witnessing heavy footfalls now as the light jewellery range at Anjali, priced between Rs.3000 and Rs.15,000 is attracting middle class customers. There is a segment that still prefers gold as one of the safest investment options and the industry has been identified as one of the growing sectors by the government.”

Major offerings

In order to make most of the consumer sentiment and lure them into making high-ticket purchases, the jewellery market is coming up with unique designs and offering great deals and freebies. The top-tier gold shops are expanding their business due to the rising demand. On September 12, 2017, PC Chandra Jewellers announced that the company will be opening six new showrooms across India as a part of its expansion strategy. Of the total, five showrooms are to be launched on September 21, while the one at Jhansi will be opened on September 23. The new showrooms will be located at Solan in Himachal Pradesh, Moradabad in Uttar Pradesh, Rajouri Garden in New Delhi, Haldwani in Uttarakhand, and Nagpur in Maharashtra apart from the one at Jhansi in Uttar Pradesh. They will be soon launching a new set of wedding collections for Diwali.

Earlier this year, Senco Golds and Diamonds had tied up with Kolkata Knight Riders for the IPL 2017 as the official jewellery partner. Their limited edition jewellery included pendants, rings, cuff links, button covers, and brooches. Occasion- and event-based limited edition jewellery often see a spike in sale.

Recently, Tanishq tied up with Hindi filmmaker, Sanjay Leela Bhansali, and it is now the exclusive jewellery partner for his period film, Padmavati. It will be launching the Padmawati collection for Diwali. Deepika Sabharwal Tewari informed BE, “For the Puja season, we have launched the new Aagomoni collection, which offers a wide array of gold jewellery across product selections. Customers can choose from the paati haar, nath, lotus inspired jhumkas, bangles, meenakari chur in addition to other stunning gold jewellery that is handcrafted with the purest gold. The collection will be available across Tanishq stores in West Bengal and is priced from `20,000 onwards.”

The export market for gold

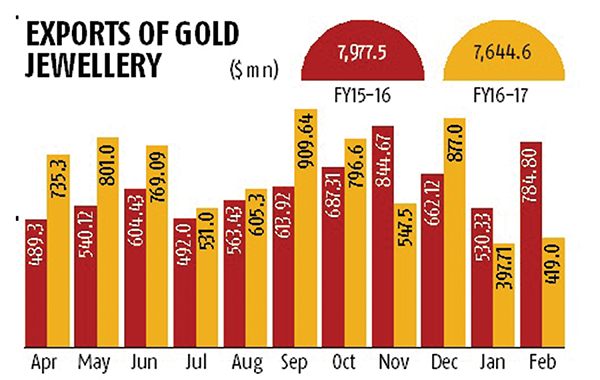

Source: GJEPC

The Indian gems and jewellery industry plays a vital role in Indian economy as it is one of the largest exporters of gems and jewellery. Net exports of gems and jewellery during April 2017 stood at $3.2 billion, showcasing a compound annual growth rate (CAGR) of 7.01% between FY05 and FY17. The overall net exports stood at $35.59 billion during FY 2016-17 registering a growth of 9.07% over FY 2015-16. The US, Hong Kong, and the UAE accounted for 75% of the total gems and jewellery exports during FY 2016-17.

According to a data by the Gems and Jewellery Export Promotion Council (GJEPC), India’s net exports of gems and jewellery stood at $35.55 billion for the financial year 2016-17 compared with $32.63 billion for the corresponding period last year. Cut and polished diamonds contributed to around 60% of India’s overall exports of precious metals and stones. India’s exports 93% of its cut and polished diamonds produced and 75% of the world’s polished diamonds. Today, 12 out 14 diamonds sold in the world are either cut or polished in India, according to the IBEF. Export of gold coins and medallions stood at $ 553.59 million and silver jewellery export stood at $ 768.92 million during April 2017. While exports of gold jewellery jumped by a marginal 1.92% to reach $8.7 billion for 2016-17, shipment of coloured gemstones declined by a marginal 3% to fall to $419.9 million.

The export of gold jewellery India channelled through West Asia have been adversely affected because of the 10% import duty levied on imported gold used in making jewellery and also by the 5% import duty on jewellery levied by the UAE, effective from January 1 this year. The export of gold jewellery dropped more than 24% in January 2017 and 47.52% in February. This has badly affected India’s export market. According to experts, there has been an increase in the number of manufacturing units set up in the UAE because of this phenomenon. These manufacturing bases are dominated largely by Indians who own similar units in India. As a result, people who work on gold are migrating to the UAE.

The data compiled by the GJEPC show gold jewellery exports at Rs.2,810.60 crore in February, compared to Rs.5,355.47 crore in February 2016. In January, gold jewellery exports had plunged to Rs. 2,707.58 crore in comparison to Rs.3,566.49 crore in January last year. Most of the gold jewellery exports to the UAE are being sent to other destinations in West Asia including Sharjah and Turkey and also to a host of African and European countries.

The organised and unorganised players

The gems and jewellery industry in India, like other MSME (Micro, small and medium enterprises) industries, is highly fragmented. This characteristic of the gems and jewellery industry leads to a high share of the unorganised players as compared to the organised sector.

The unorganised MSME players have 90% share in gold jewellery manufacturing and 70% share in retail. With the implementation of 3% GST on jewellery making charges which were nil earlier, increase in the cost of production and therefore in the price of the final good is expected. This has made estimation of cost difficult for the manufacturers. Gems and Jewellery sector employ millions of skilled workers (karigars). Levying a tax of 5% on making charges has affected the karigars, especially the ones in the unorganised sector. Making of a jewellery piece involves many activities like mounting, setting and polishing which need different sets of karigars.

Deepak Soni, a jeweller based in Jaipur, while talking to BE said, “A lot of paper work is now involved after the implementation of the GST and since the karigars are not educated they are finding it difficult to cope with the situation.”

The sector provides employment to nearly 2.5 million people with the potential to generate employment of 0.7 to 1.5 million over the next five years. Increasing base of consumers as well as growth of high net worth growth individuals (HNIs), will contribute to the continued fast pace growth of organised jewellery retail in India. Presently, the unorganised players use indigenous technology which leaves little opportunity for the growth. On the other hand, the organised players seem to be quite satisfied with the new GST regime. The big organised players think that these changes will help the sector grow into an organised and mature industry and bring transparency and increase in tax compliance.

Branded jewellers are launching new designs according to consumer preferences which local players fail to do.

Anjali Mittal, a professional from Kolkata, told BE, “Branded jewellers have a lot of variety in different segments of jewelleries. Buying jewellery pieces from branded shops saves a lot of time as I don’t have to think about the design and explain it to the local jewellery makers. In branded stores I can choose my right fit as they have jewellery according to consumer preference.”

Gold versus silver

A large section of the consumer base is opting for the pleasure of acquiring a precious metal at a smaller ticket size. Silver jewellery is perceived to be more of a fashion statement rather than a precious jewellery. Fashionable young Indians prefer light weight contemporary jewellery over heavy weight jewellery. But the festive and wedding seasons will generate demand for heavy jewellery. Deepika Sabharwal Tewari added, “Our customer conversations tell us that people are looking at heavy weight heritage inspired gold jewellery and diamonds for this festive season. With Diwali approaching and the wedding season in tow, the heavy weight gold jewellery is a natural choice now. Gold is a category for adornment seekers and investors. Silver is more for artifacts. Gold will always dominate the Indian market.”

Jewellers have opined that craze for gold will always be stable. Silver is mostly considered within a particular niche section and mostly for gifts and fashion jewellery.

Gold Reserve

According to Forbes, the beginning of the year 2010 saw central banks around the world turning from being net sellers of gold to net buyers of gold. In 2015, they collectively added 483 tonnes, the second largest annual total since the end of the gold standard, with Russia and China accounting for most of the activity. The second half of 2015 saw the most robust purchasing, according to the London-based World Gold Council (WGC). India is among the top ten countries with the largest gold holdings of around 557.7 tonnes.

Bank of India has one of the largest stores of gold in the world. India is among the largest consumers of the precious metal, and is one of the most reliable drivers of global demand. India’s festival and wedding seasons have historically been a huge boon to the industry. The percentage of foreign reserves is 6.3%.

Indian households are the world’s largest hoarders of gold and hold a record 23,000-24,000 tonnes of the precious metal worth at least $800 billion, according to a comprehensive study by the WGC. The country’s gold demand has been shaken after demonetisation but long-term prospects remain bright with demand expected to average at 850-950 per annum by 2020. The country’s gold demand had fallen to a seven-year low of 650-750 tonnes in 2016, although a recovery is expected.

Top five places around the world to buy gold this Dhanteras

Dubai, UAE: Dubai is the most famous destination for buying gold. The Gold Souk area in Deira is the hub for gold shopping and you should see the festive crowds and the elaborate display of gold to believe it. With shop windows literally laden with gold ornaments, you will be speechless on seeing the glittering display. Watch out for the Dhanteras and Diwali promotions and discounts, where you can buy gold at a steal.

Best Places to Buy Gold: Dubai Gold Souk, Joyallukas, D’damas, The Gold and Diamond Park, Malabar Gold.

Quick Tip: Negotiate hard and take quotes from a few stores before you buy anything. Do not miss Diwali and Dhanteras for the best promotions and deals.

Bangkok, Thailand: Buying gold in this city is exceptionally satisfying because of the low margins and the wide range of choices. The Yaoworat Road in China Town is a must visit for gold diggers. Exercise caution while buying gold in Bangkok, as many shops might sell gold cheap but the quality could be highly questionable. Yaoworat Road is a trusted location for gold shopping.

Best Places to Buy Gold: Hua Seng Heng and Tao To Kang at Yoaworat Road in China Town.

Quick Tip: Always go to reputable gold shops and don’t follow the word of tuk tuk drivers who get a cut at places they suggest for gold shopping.

Hong Kong, China: Hong Kong is also one of the most active gold trading markets around the world and is a price setter for other places around the world. Leveraging from this dominant position, buying high quality gold jewellery in Hong Kong can be a real steal. Goldsmiths in Hong Kong are known for their creative designs and you can also get customised pieces designed instead of buying off-the-rack jewellery.

Best Places to Buy Gold: Chow Sang Sang, Luk Fook Jewellery, Chow Tai Fook

Quick Tip: Lookout for the term Chuk Kam in Hong Kong, which means the purity of gold is 99% or higher.

Kochi, India: At a traditional wedding in Kerala there is a lot of importance given to gold and ornaments worn by the bride and on the exchange of gold gifts between the bridal parties. Buying gold is one the most common investments in Kerala and gold is bought and sold during Dhanteras with a lot of enthusiasm.

Best Places to Buy Gold: Malabar Gold, Bhima Jewels, Joyallukas, Malabar Gold and Diamonds

Quick Tip: Kerala has a higher percentage of exchange of gold ornaments rather than purchasing new ones. How about getting your old gold bracelet out and buying yourself something new this Dhanteras?

Zurich, Switzerland: Switzerland is one of the best places in Europe to buy and store gold. Those famed Swiss bank accounts have large chunks of gold stored in them and many Indians and Europeans flock to this tax-haven to buy gold. Buy jewellery or gold bars in Zurich after choosing from the most exquisite designs made by craftsmen. Bahnhofstrasse, Zurich’s main downtown street, is also a great place to purchase gold encrusted watches, accessories and eyewear, which are definitely worth adding to your collection of precious items.

Best Places to Buy Gold: Bucherer, Cartier, Tiffany and Co., Bulgari, Chopard

Quick Tip: Shop for gold at the designer stores, which guarantee exquisite designs as well as have great brand value.

Add new comment