Company Background

lBharat 22 ETF (Exchange Traded Fund) is the second ETF that will be launched by the Union Finance Ministry after NSE CPSE ETF and is managed by ICICI Prudential Mutual Fund AMC.

l ETFs are index funds that are listed and traded on stock exchanges just like regular shares. They are a basket of stocks with assigned weights that reflects the composition of an index.

l S&P BSE Bharat 22 Index comprises of 22 scrips of public sector units (PSUs), banks and those entities in which the government holds the stake. Bharat 22 is a well diversified ETF spanning six sectors — Basic Materials (5.1%), Energy (18.8%), Finance (18.7%), FMCG (14.3%), Industrials (22.5%) and Utilities (20.6%).

l Bharat 22 ETF will act as one of the innovative vehicles for achieving the GoI’s divestment target of `2,500 crore in FY 2017-18.

l The investment objective of the Scheme is to invest in 22 companies of the underlying Index. The capital allocation to individual company equity by the ETF is expected to be the same as the individual weight of each company featured on the Bharat 22 Index.

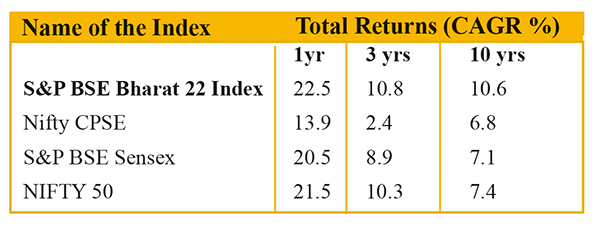

l The S&P BSE Bharat 22 Index is designed to measure the performance of selected companies, disinvested by the Central Government of India according to the disinvestment programme.

Key Features

Key Features

Diversified Portfolio - The ETF would feature diversified investments of 22 Blue Chip Stocks of companies across six different sectors. It includes 19 state owned companies like ONGC, IOC, SBI, Coal India, etc. and remaining 3 consists of those companies where GoI holds the partial stake like ITC, L&T, and Axis bank.

Seeking Stability and Growth - Stocks included in Bharat 22 belong to six different sectors- Basic Materials, Energy, Finance, FMCG, Industrials and Utilities which give a mix and balance portfolio to the investor and provides stability and growth.

Offer - The Government of India has offered a discount of 3% to all the investors of Bharat 22 ETF during the NFO.

Large Cap Orientation - Bharat 22 ETF includes 22 companies out of which 92% consists of some of the largest companies listed on the stock exchange in terms of market capitalization.

Dividend Yield – It provides dividend yield of 2.4 as on September 2017 against 1.2 in S&P BSE Sensex and Nifty 50 respectively.

Futures and Options – Its highly liquid index is because more than 99% of index constituents are available under F&O segment.

Annual Rebalancing – Annual rebalancing mechanism will track the Bharat 22 Index which might involve an annual change in the proportions of the individual investments made by the ETF in individual securities featured in its portfolio.

Real Time Investment/Redemption – Trading of ETF can be done through multiple routes - the stock market as well as direct trade from the fund house i.e. ICICI Prudential Mutual Fund AMC which allows the investors to complete their trades in real time. Thus the potential liquidity offered by the Bharat 22 ETF might be superior.

Recommendation – Bharat 22 ETF provides an opportunity to invest in the diversified portfolio of public sector companies in which GoI has the stake. ETFs due to the benefits of its low cost, transparency and liquidity are preferred by investors. Hence, we recommend to SUBSCRIBE the issue.

The writer is research head of AUM Capital

Add new comment