The NDA government has done an excellent job in building a national consensus for the roll-out of Goods and Services Tax (GST). There will be six different rates – 0%, 5%, 12%, 18%, 28% and 28%+cess – for different categories of goods and services and as of now, the items which will be kept outside the purview of the GST are alcohol, electricity, land and real estate, education, and healthcare. While there has been a general guidance that every item will be slotted into a tax rate closest to its current rate of taxation, everyone is now waiting for May 18-19 when the actual announcement will come regarding which goods and services will be taxed at what rate. As it stands now, the GST, with these multiple rates, will be complex and the exemptions will make GST calculation challenging, at least during the initial phase. Nonetheless, the very fact that GST is now ready to be rolled out most likely from July 01, 2017, is a big achievement in itself and the government needs to be congratulated.

The NDA government has done an excellent job in building a national consensus for the roll-out of Goods and Services Tax (GST). There will be six different rates – 0%, 5%, 12%, 18%, 28% and 28%+cess – for different categories of goods and services and as of now, the items which will be kept outside the purview of the GST are alcohol, electricity, land and real estate, education, and healthcare. While there has been a general guidance that every item will be slotted into a tax rate closest to its current rate of taxation, everyone is now waiting for May 18-19 when the actual announcement will come regarding which goods and services will be taxed at what rate. As it stands now, the GST, with these multiple rates, will be complex and the exemptions will make GST calculation challenging, at least during the initial phase. Nonetheless, the very fact that GST is now ready to be rolled out most likely from July 01, 2017, is a big achievement in itself and the government needs to be congratulated.

However, what has confused many is the recent introduction of some worrying clauses into the GST statute. The GST Council has brought in an anti-profiteering law to ensure that if any item, under the GST regime, is taxed at a rate lower than the rate at which it is taxed now, the reduction in taxes must be passed on to the customer. Apparently very pro-consumer, but how feasible will be this in terms of actual implementation? No pricing of goods or services can be done just on the basis of a bill of materials. In addition, input costs in terms of electricity and even petroleum are variable items which can influence pricing of the goods or service in question. This can lead to confusion. In India, given the track record of tax officials to misuse their powers, this can result in unnecessary harassment for the average trader and businessman.

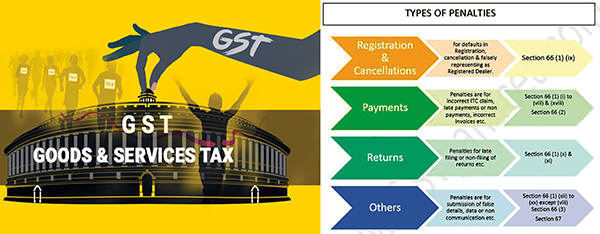

There is an additional provision which says that evading tax or incorrectly taking an input credit of more than ` 5 crore will be a cognisable and non-bailable offence. Although it is aimed at deterring would-be evaders, this empowers the taxman more. More importantly, under the proposed norms for cognisable offences, the police can arrest without a warrant and start the investigation with or without the permission of a court. The punished can even get imprisoned for up to five years in prison apart from the fine for tax evasion of more than ` 5 crore.

The penalty clauses are quite draconian to say the least. We must not forget that the GST regime is a new one and also quite complicated. People will need more time to get accustomed to the new rules. There will be teething problems and mistakes will happen. But they should not be penalized for honest mistakes. Such rules can do immense damage to the spirit of entrepreneurship and that is something which, we as a nation, cannot simply afford at this stage.

It is indeed surprising that these clauses were introduced by a government which, in their election manifesto, had promised to curb ‘tax terrorism’. We sincerely hope that good sense will prevail and the government will be successful in keeping the tax officials and their powers under check.

Add new comment