As India enters the new fiscal year, the agricultural landscape remains at the forefront of economic concerns. Last year witnessed significant restrictions on the import and export of various agricultural commodities as the nation struggled with rising food inflation following fear of a fall in farm output due to unanticipated weather patterns. Now, as the country steps into 2024-25, policymakers are busy with the balancing exercise of supply- demand equation of foodgrains

The policymakers’ concern is reflected in the projected decline in foodgrains production last year. The second advance estimates of the agriculture and farmers’ welfare ministry, total foodgrains production in 2023-24 is counted at 309 million tonnes. This is 6.1% lower compared to about 330 million tonnes foodgrains production in 2022-23. Among other reasons, poor and uneven monsoon caused by the El Nino weather phenomenon affected agricultural production as a large acreage of the country’s crop land is still dependent on monsoon rain.

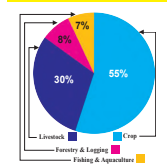

India is one of the major players in the agriculture sector worldwide and it is the primary source of livelihood for nearly three-fifths of India’s population. India has the world's largest cattle herd; the largest area planted for wheat, rice, and cotton, and is the largest producer of milk, pulses, and spices in the world. It is the second-largest producer of fruit, vegetables, tea, farmed fish, cotton, sugarcane, wheat, rice, cotton, and sugar. The agriculture sector in India holds the record for second-largest cropped land in the world generating employment for about half of the country’s population. Thus, farmers become an integral part of the sector to provide us with a means of sustenance.

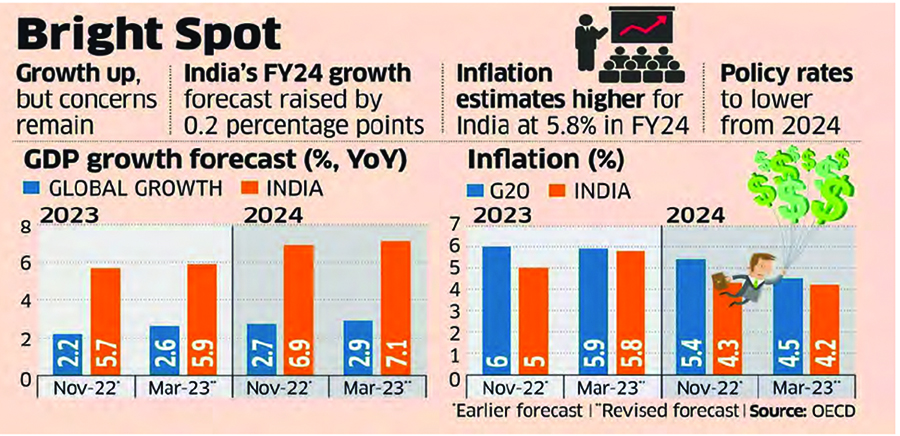

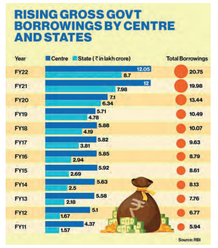

With significant forward linkages, the agriculture and allied activities sector contribute significantly to the country's overall growth and development by ensuring food security. The Indian agriculture sector has been growing at an average annual growth rate of 4.6% during the last six years. It grew by three per cent in 2021-22 compared to 3.3% in 2020- 21. In recent years, India has also rapidly emerged as the net exporter of agricultural products.

Foodgrains production rises steadily

And if a projected decline in foodgrains production in 2023-24 is a cause of concern, this is unlikely to affect foodgrains availability matrix or cause any serious supply chain disruption. This is because of huge buffer stocks of foodgrains following a steady rise in foodgrains production in the country over the years. Foodgrains production in India touched a record 330.5 million tonnes in 2022-23 (3rd advance estimate) – up by nearly five percent over the production of 2021-22.