Company Background

Birla Corporation Limited (BCL) is the flagship Company of the M.P. Birla Group. The Company is primarily engaged in the manufacturing of cement as its core business activity. It has significant presence in the jute goods industry as well. The Company has recently acquired the entire cement business of Reliance Infrastructure Ltd for an Enterprise Value of `4,800 crores. This acquisition has provided the company with the ownership of high-quality assets, taking its total capacity to 15.5 mtpa. It has cement plants in Rajasthan, Madhya Pradesh, Uttar Pradesh and West Bengal.

Investment Rationale

l BCL is planning to invest `2,400 crore for setting up a four million-tonne clinkerisation unit with a grinding facility at Mukutban in Maharashtra, after the completion of the new plant, the total cement production capacity of the company would touch 20 mtpa from the present 15.5 mtpa

l To improve operational efficiencies in the acquired Reliance plant BCL is planning to install Waste Heat Recovery System (WHRS) and remove infrastructural bottlenecks.

l Governments continued focus towards infrastructure development, affordable housing, smart cities, concrete roads etc is expected to lead to increased demand for cement. An increase of 38 per cent and 23 per cent in the government’s fund allocation in its annual Budget for the housing and roads sectors, respectively, to `23,000 crore and `64,900 crore, is expected to boost cement uptake.

l BCL’s Jute Division has recorded the highest ever annual turnover and cash profit, amounting to `327.62 cr and `31.61 cr, respectively. The improved performance can be attributed to investment made in the recent past for modernization, continuous improvement in productivity and judicious change in the product mix, matching market demand. Going forward jute is likely to do well.

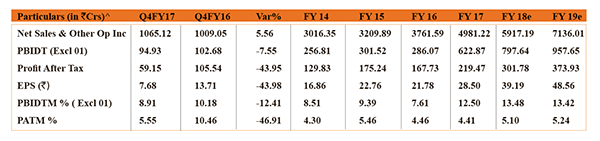

l In Fy17, the revenue of the Company increased by 32 % to `4,981.22 crores. EBIDTA for the year was `769.41 crores. The Profit after Tax stood at `219.47 crores, recording an increase of 31%.

l The company has been consistently paying dividend. For FY17, it had given a dividend of 65% on equity share@ face value of `10 each.

l Improving demand and acquisition of Reliance Cement are expected to be key growth drivers for the company. Moreover cost reduction measures such as waste heat recovery plant, high usage of fly ash and pet coke would lead to margin expansion not to forget the improved performance from the jute division that would again lead to better numbers. At the CMP of `947.75, the stock is trading at FY19E P/E of 19x. We recommend a BUY on the stock with a Price Target of `1115 (23x FY19E EPS) with an upside potential of ~18% from the current level with an investment horizon of 9-12 months.

The writer is research head of AUM Capital

Add new comment