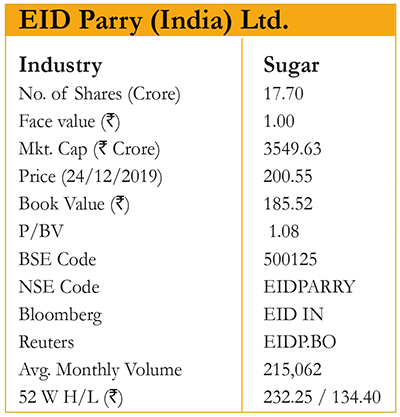

Company Background

EID Parry (EID), incorporated in 1975 is a significant player in sugar with interests in promising areas of Nutraceuticals business. Headquartered in Chennai, India, the Company is a part of the Rs. 369 Billion Murugappa Group, one of India’s leading business conglomerates. It is one of the oldest companies in India that has been in business for more than 225 years. It has many firsts to its credit, including the manufacturing of fertilizers (1906) for the first time in the Indian subcontinent. The company is one of South India’s leading suppliers of sugar to the institutional as well as retail segment. Along with Sugar the Company is also focused on Co-generation (Power), Distillery (Spirits), and Nutraceuticals business segments.

Investment Rationale

l It is one of the top five sugar producers in the country. EID has eight sugar factories spread across South India with a total sugarcane crushing capacity of 43,800 Tonnes of Cane per day, co-generation capacity of 160 MW of power and four distilleries having a capacity of 234 KLPD.

l The company has a significant presence in Farm Inputs business through its subsidiary, Coromandel International Ltd.. Crop Protection business registered a revenue growth of 8%, driven by higher exports and domestic formulation performance.

l EID holds 60.55% of shares of the value of ~ Rs. 9,200 crore as on date in listed Coromandel International Ltd, India’s one of the largest Phosphatic fertilizer player.

l In the Nutraceuticals business (focuses on the business of human wellness through Health Supplements and Functional Foods by offering high quality products backed by Science, addressing the global markets), is a pioneer and world leader in organic spirulina and micro algal products with all major global certifications. ‘ParrysSpirulina’ is sold in more than 40 countries across the globe with manufacturing units in U.S.A and Chile.

l EID Parry has a 100% stake in Parry Sugars Refinery India Private Ltd. and US NutraceuticalsInc, USA.

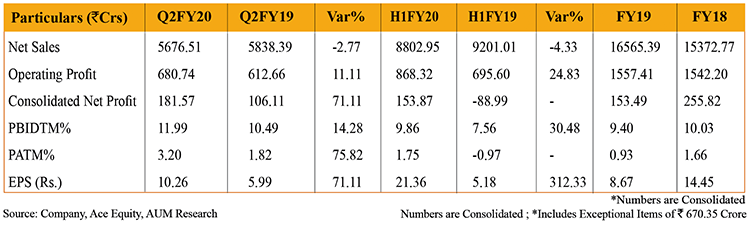

l For the period of FY14-19, its topline and bottomline grew at a CAGR of 7% and 15% respectively. In Q2FY20 its standalone sales grew by 26% but PAT declined to Rs. 6 crore as compared to Rs. 11 crore in Q2FY19 due to muted sugar prices on account of higher sugar inventory and release order mechanism. On consolidated basis its topline declined a bit but bottomline grew robustly by 71%.

l On standalone basis, the Company has drastically reduced its debt from Rs. 1,977 crore in FY14 to Rs. 832 crore in FY19 by focused cost management and fiscal prudence.

l Parrys White Label, Parrys Refined Pure and Amrit are EID’s portfolio of branded sugar for the retail market. Its Amrit brand sugar offers 100% natural cane sugar with 10 times more nutrients.

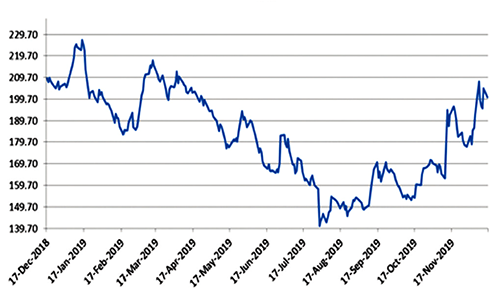

l The Government of India has been taking various supportive measures in order to provide stability to the sugar prices, in the form of Buffer Stock mechanism, Minimum Support price for Sugar, Export quota and related subsidy and upward revision of Ethanol price including ethanol supply from ‘B’ Heavy molasses and cane juice. The sugar prices also improved compared to the previous quarter due to floods in Karnataka & Maharashtra which affected the movement of sugar stocks from these states to other states, thereby benefitting the company.

l India is the largest producer of sugar in the world displacing Brazil and is also the largest consumer. Indian Sugar industry is showing signs of complete turnaround with two consecutive years of record sugar production. In 2018-19, India produced an all-time high 33.16 million tonnes of sugar but for the first time since 2016-17, the country will produce less sugar than the year before at about 26 million tonnes, lower by 21.5% for the ongoing marketing year considering possible fall in cane acreage in Maharashtra and Karnataka as well as diversion to ethanol manufacturing, according to industry body Indian Sugar Mills Association (ISMA).

l Sugar industry is poised to break its own export record this year due to flurry of overseas sales in the past few months, prompted by attractive global prices.

Recommendation – With a growing shift towards natural and organic products, the Company has positioned itself strongly in the field of human health and wellness. EID is the first and amongst few with a dedicated R&D wing and cane breeding program. Its innovative programs in sugarcane cultivation methods have set industry benchmarks in yield and recovery. At the CMP of Rs. 200.55, the stock trades at ~6 times FY21 EPS of Rs. 34. Hence, we recommend a BUY on the stock with a Target Price of Rs. 272 with an upside potential of 36% from the current level with an investment horizon of 9-12 months.

Add new comment