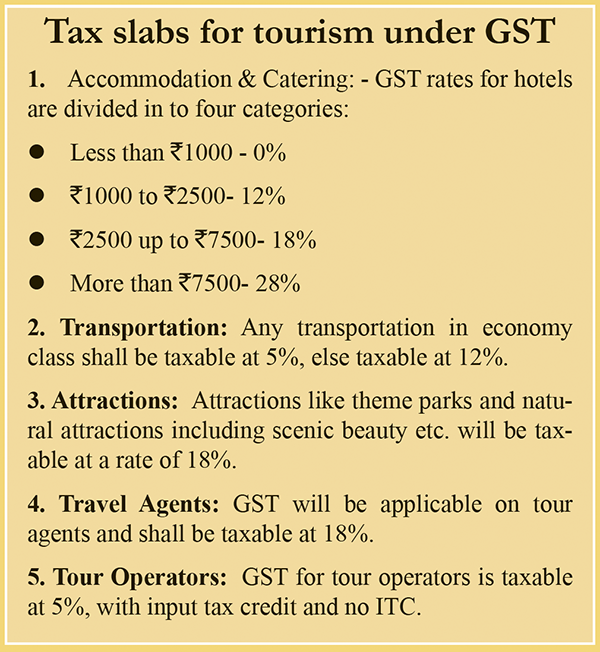

Under the previous tax system, the traveller had to pay different taxes like service tax for the rooms, restaurant, banquets, cab service, internet and others, VAT for food and beverages, alcohol, in room sale of food (such as in room dining, mini bar etc), customs and excise duty, central excise duty on the manufacture of bakery products, state excise on alcohol, etc. Additionally, there were other taxes like the luxury tax on room rentals, entertainment tax on casinos, discos, videos, state entry taxes and many other taxes. However, the new the Goods and Services Tax (GST) has made the process much simpler.

Positive impacts

Under the GST, all the indirect taxes are merged together under one single tax system that runs uniformly across the country. This will help the Indian tourism industry and bring about a much needed parity across tourists destinations in India. According to Mahesh Iyer, COO, Thomas Cook (India), “We are delighted that the GST has been passed which is a truly crucial development towards a unified tax regime, vital in addressing the ambiguities of the current indirect tax landscape, and hence beneficial to the economy as a whole. India is a key emerging market for our sector and this move will strengthen the confidence among international investors.”

While the rate burden is reasonable for the budget hotels, it is on the higher side for the luxury hotels. Sharat Dhall, President, Yatra.com, informed, “The passing of the GST bill is a great step forward and establishes a uniform tax structure which will allow the free flow of goods across the country and should have a positive economic impact. However, the government will need to make an exception for the airline sector as the current service tax ranges from 5.6% to 9% of the base fare, which is considerably less than the GST rate that is being spoken about, of 15-18%.”

Daniel D’Souza, Head Sales, India and NRI Markets, SOTC Travels, told BE, “The 5% GST rate on tour packages is a welcomed move for consumers. However, high end hotels and business class air travel is going to be costlier under the GST. Countries that have adapted GST have grown in their GDP. The implementation of GST will now rationalize and simplify our tax regime. In the long term, it is expected to enable the much-required growth needed for the travel industry.”

Negative impacts

The tourism sector, which was already reeling under demonetisation may weaken further after the implementation of the GST. According to Garish Oberoi, Vice President, Federation of Hotels and Restaurants Associations of India (FHRAI), “The initial reaction is of great despair. 28% taxation in our segment will be the end of the industry.”

The GST has led to higher tariffs and increased cost burden in the tourism and hospitality sector. As India is emerging as a global destination, services should be at par with global rates. India’s neighbouring countries like Japan and Singapore have very low taxes of 7% and 8% for their hospitality sector which has helped to establish them as major tourist destinations. The higher tax slabs in the sector is likely to make India uncompetitive in the international market.

Amit Taneja, Chief Revenue Officer, Cleartrip, told BE, “GST has brought in a mixed bag of offerings for the travel and tourism industry. While the air travel faces the brighter side, the hotels are to hit tough shores. We have witnessed a week on week volume increase by 7% for domestic and 9% for international in the week after GST implementation, which was concurrent with an average dip in fare prices.”

He added, “The hotels’ segment gets an overall cost increase. Especially, with the applied GST of 28%, the segment of rooms with tariffs above Rs.7,500 is to face maximum negative impact, where the proposition with a considerable tax portion may appear less attractive to travellers. It may also pose a threat to meetings, incentives, conferences, exhibitions (MICE) business where tax friendly locations like Thailand and Sri Lanka may appear more lucrative in terms of cost effectiveness. The new tax amendment will help the Indian domestic aviation but might not give a similar push to the overall tourism industry.” According to initial industry estimates, the total losses are estimated to be around Rs.500 crore for the whole hospitality sector in India.

Archit Gupta, Founder & CEO, ClearTax, told BE that the prices of luxury hotels and business class air fare have increased due to increase in GST rates. Booking through agents is costlier as agents will charge 18% GST instead of the earlier 15%. The price of rail tickets remains the same. GST is a mixed bag of better and easier rules and regulations and increased costs and compliances. The Hotel and Restaurant Association (Wester India) or the HRAWI had been lobbying for a GST rate of 5% as it believed that a lower rate will bring in more tourists and allow Indian businesses to compete with global chains. However, the GST Council deemed it fit to set the rate at 18%.

Impact of GST on the new age traveller

With the international tourist destinations becoming cheaper, the Indian travel market is also getting young. The implementation of the GST has also made it easier for the adventurous and impulsive new age travellers with cheaper air tickets, unchanged price of train tickets and a 0%-12% GST on hotel tariffs ranging below Rs.2500. The young travellers being digitally accustomed wouldn’t require any travel agents and can easily cut down on the travel agents and tour operators’ cost. However, luxury travel has become much costlier as five star stays incur a high GST rate. This may affect the luxury travellers and hit their pockets harder. This is also likely to affect the luxury Indian tourism sector as these travellers would prefer visiting international destinations for their lower tax rates. Likewise, this can also affect the inbound tourism largely.

Add new comment