The Reserve Bank of India (RBI)’s Monetary Policy Committee (MPC) decided on August 6, 2021 to maintain its policy rate in the light of its accommodative stance, unchanged at 4% adopted since August 12, 2020. That was when RBI decided to cut the rate to boost economic activities following the onset of the pandemic Covid-19 induced worldwide recession.

The policy rate is the rate known as repurchase obligation rate (REPO) at which banks can borrow from RBI for one-day loan against the collateral of a government bond with the obligation to buy back the bond with interest amount. The policy rate is a kind of lighthouse signal to the economy what the rate would be around which, interest rates should revolve for businesses as well as households for getting loans from financial institutions. Following the decision to maintain REPO rate at 4%, RBI has also kept the reverse REPO rate unchanged at 3.35% under Liquidity Adjustment Facility (LAF), under which RBI sells bonds to banks for absorbing surplus funds in the economy. So too, the marginal standing facility (MSF) rate and the Bank Rate are continued at 4.25% at which banks borrow to tide over temporary shortages.

Nascent and hesitant recovery

Governor Das joined RBI in mid December 2018 when the Indian economy was not doing well. The dominating reasons included falling rate of investment, with the financial sector over burdened by non-performing assets and the consequent banks’ reluctance to lend any more. As his first policy rate decision in February 2019, he reduced to the REPO rate by a modest 25 basis points (bps) from 6.5% to 6.25%. Thereafter under his stewardship, RBI has slashed the policy interest rate by a full 250 bps to 4% in August 2020. Governor Das made it clear in the latest policy statement that “continued policy support from all sides — fiscal, monetary and sectoral — is required to nurture the nascent and hesitant recovery.” The key point to note here is “fiscal support”.

The RBI cannot directly undertake fiscal expansion. It can only advise. It can also facilitate financing fiscal deficits of central and state governments, resulting from unprecedented Covi-19 related expenditures since 2019. Central government’s and States requirements to finance deficits were reported to be around ` 12 lakh crore sand ` 10 lakh crore, totaling ` 22 lakh crore. It is better to keep a low rate of interest to enable governments borrow at low interest rate and keep interest expenditure as low as possible.

In fact, as Professor Ajit Ranade noted in a recent article, there has been shortage of funds in the banking system, as deposit growth has been sluggish. The RBI’s Government Securities Acquisition Program (GSAP) seems to have been launched to solve this problem, under which RBI is buying Rs one lakh crore worth bonds in each quarter beginning from first quarter of 2021, for a total of Rs 4 lakh crore. Similarly, financing fiscal deficit may also be done through an indirect manner by RBI, through secondary market by buying bonds issued by Government.

Will it not be inflationary?

Very appropriate question in the light of a famous dictum by Prof Milton Friedman : “Inflation is a monetary phenomenon, anywhere and everywhere”.

The RBI has the ready answer. While RBI through its market operations has maintained ample surplus liquidity since the April 2020 after spread of Covid pandemic for easing financial conditions to boost credit growth and aggregate demand, it has also been absorbing surplus liquidity through reverse repos, as the latter surged from a daily average of ` 5.7 lakh crore in June to ` 6.8 lakh crore in July 2021. The surplus liquidity in the banking system was at ` 8.5 lakh crore on August 4.

Aside from overnight fixed-rate reverse repo auctions, RBI would conduct two more Government Security Acquisition Programme (G-SAP) operations of ` 25,000 crore each on August 12 and 26 for absorbing liquidity. Also planned are four variable reverse repo rate (VRRR) auctions in the fortnight beginning August 13 till September 24 for absorbing surplus funds from the banking system over the next four quarters: first quarter for ` 2.50 lakh crore, the second (on August 27) will be for ` 3 lakh crore, the third (on September 9) will be for ` 3.5 lakh crore, and the fourth will be for ` 24 lakh crore. The VRRR auctions are popular, because of attractive bid-cover ratio. However, there would remain adequate liquidity, as assured by RBI, more than ` 4 lakh crore, even after four VRRR auctions.

What is missing?

One thing that would strike any newspaper reader is the Press statement issued at the end of the meeting on August 6. It says “MPC also decided to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of COVID-19 on the economy, while ensuring that inflation remains within the target going forward”.

The question is: Is RBI ignoring the signs that show the inflation tolerance level at 4% plus the allowed margin of 2% has been exceeded for two months in succession, May and June this year?

The answer is “No”, as RBI Governor Das clearly recognizes inflation was 6.33% and 6.26% in the two months. But, he is confident that the inflationary pressures appeared to be “transitory and were due to supply side factors”.

RBI appears to believe that prices would fall with the “arrival of khariff crops and impact of supply measures”. True, favourable weather conditions with optimum amount of rains and absence of natural disasters, including floods, would ensure smooth flow of adequate food grains and edible oil and fruits as well as vegetables including the proverbial “election-result-determining onions and tomatoes” would keep consumer price inflation down; and inflation would fall below 6%.

The recent inflation is, however, attributed to steady rise in world prices of petroleum crude, since December 2020. India, a highly crude import dependent country, gets 83% of its total requirements from overseas. The world benchmark Brent price fell to a historically low price, $ 20/barrel in April 2020 due to the Covid 19 induced worldwide recession, soon after the outbreak of the pandemic. Once, efforts to develop vaccines came to be known, crude price looked up. Eventually after vaccines were introduced, economic recovery was more certain. There was no stoppage of rise in the world price of crude: from $48.73/barrel in December 2020, it went up to $53.70 in January to $ 66.40 and $ 75 in June and hovered around $75 in late July.

Monthly consumer price index (CPI) includes only core items of consumption. It excludes the volatile items of food and fuel. On the other hand, the rise in the wholesale price index (WPI) is immediate, as rise in transportation costs are duly reflected in its computation. Diesel is most used fuel of all refined fuels for road transportation. The CPI takes into account, eventually, though after some lag in time, increases in costs of transportation of raw material and intermediate goods that go into the production and distribution of final goods and services. Due to increasing trend in fuel prices since December 2020, WPI inflation rose from 1.95% in December 2020 to 4.2% in February, 2021 and thereafter to 7.89% in March, 10.49% in April and 12.95% in May. The May 2021 WPI inflation is a record. In June WPI inflation has slightly eased to 12.01, which is a relief, mainly because of large arrivals of fruits and vegetables.

The monthly consumer price inflation rose from 4.59% in December to 5.03% in February 2021, it went up to 5.52% in March 2021and touched 6.31 in May, 2021. That was a dangerous level, being more than the RBI goal of 4% with an allowable margin of 2%, totalling 6%. In June, CPI inflation is lower at 6.26%. However it is still above the limit. The July WPI and CPI indices will be available in mid August.

The RBI’s Press Statement makes it clear that it RBI recognizes there has been a considerable hardening of commodity prices, particularly of petroleum crude. However, RBI seems to have has taken comfort from the so called agreement within the Organisation of Petroleum Countries (OPEC) Plus to raise oil production for “a likely restoration of output to the pre-pandemic levels by September 2022”; and RBI is optimistic that assurance to the world by OPEC “imparted transient softening to spot and future crude prices” from the recent peak in July.

Can we assume we will return to “normalcy” by September 22, which is still too far?

The OPEC decisions to “expand and cut output” are often unreliable as they are unpredictable. That is not unusual from an oligopoly.

Recall what Adam Smith wrote in his The Wealth of Nations (1776):

“It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own self-interest. We address ourselves not to their humanity but to their self-love, and never talk to them of our own necessities, but of their advantages”.

The latest decision by OPEC plus to step up crude output in August this year was due to successful persuasion by Russia as its revenue has been falling in the context of the worldwide recession induced by Covid 19. Russia is highly dependent on oil exports to rest of the world for its revenue. All the OPEC plus nations are hungry for revenues as their earnings for the past 15 months have declined because of Covid-19’s aftermath and fall in worldwide demand for petroleum crude. Any assurance of raising the output cannot be relied upon. They may hold it up and raise prices, blaming it on demand outstripping supplies; or may even cut the output.

One cannot assume inflationary pressures are “transient and transitory”; or “brief and temporary”; and they would disappear.

If you believe in Adam Smith, you would know human nature: self-love first, not humanity! Any time, OPEC Plus would act in opposite direction.

One cannot postpone the decision, which is to “cut the taxes on fuel and bring a quick end to inflation”. That is the role of fiscal policy, the exclusive privilege of Government.

RBI’s past advice

In fact, RBI has given such an advice on more than one occasion. In a public address on February 2021, delivered as part of 185th Foundation Day Celebrations of Bombay Chamber of commerce and Industry, Governor Das said fuel taxes impact cost side of every activity, manufacturing or transportation of raw materials as well as finished products. He pleaded for coordination between the Centre and States towards implementing over an agreed time frame to cut taxes and levies imposed on petrol and diesel. In the minutes of MPC meeting held in February 2021, a specific suggestion was made for “a calibrated unwinding” of Central and States taxes.

Two months ago, on June 2, soon after its decision continuing the policy rate of 4%, MPC again called for a reduction in taxes and duties imposed on petrol and diesel by central and state governments. That is time when prices of petrol crossed ` 100 per litre due to a rise in international crude prices combined with taxes imposed by the central and state governments. Taxes currently constitute 58% of the retail selling price of petrol and around 52% of the retail selling price of diesel.

The MPC meeting of June 2021 had forecast that the full-year inflation would be at 5.1%.The August 2021 MPC has revised inflation upwards to 5.7%.

No advice this time!

Yet, not a word on cutting taxes and duties this time; no suggestion from MPC or Governor on cutting them; and RBI has totally refrained this time from making any remark.

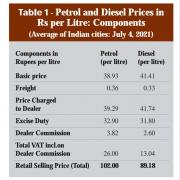

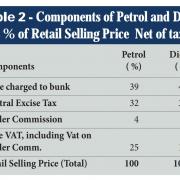

Tax revenue from the petroleum sector for the Centre and States in 2019-20 was ` 5.6 lakh crore: for the States, it was ` 2.6 lakh crore from VAT. They respectively amounted to 18% of total revenue of the Centre; and 7% of the States’ revenues. The petrol retail selling price (RSP) on July 4 was ` 102 per litre. The major component was total taxes (central excise and state VAT), amounting to ` 59 or 57% of petrol RSP per litre. Tax rate, when expressed as total taxes on net price, was 137%. In regard to diesel, the major component was also central excise and state VAT, ` 45 or 61% of diesel RSP. Tax rate was 101%. The prices charged to petrol bunk for petrol and diesel by dealer, including basic price, freight and dealer commission, would only be ` 43 and ` 45.

Under a likely scenario, assuming impossibility of obtaining agreement with all states and getting approval from GST Council, the Centre has to act unilaterally and early. Utilizing the data (Table 1) provided by Annapurna Singh in Deccan Herald (July, 4 2021), we calculated tax rates in percent (table 2) as taxes as percent of selling price net of taxes,. In an extreme case, if the Centre suspends excise on petrol for one year, the tax burden would be only VAT, ` 26 per litre and the tax rate would be 60% of net price of ` 43. If the centre also decides suspension of excise on diesel, for one year, the State VAT would be `13.04 per litre. The total loss for the Centre would not exceed more than as ` 3.46 lakh crore, as estimated as revenue for the a full year.

No doubt, it would be an addition to the estimated fiscal deficit of Central Government, 7.8% and state fiscal deficits, 4% of GDP, in all a total deficit of 12.8% of GDP. Any additional deficit by suspension of central excise can be financed by RBI, as being done through: specifically issued bonds can be bought indirectly through secondary market by RBI. This suggestion is worth considering, as gains from the anti-inflationary measure would be considerable. As the interest rate has been kept low, the interest burden for financing the deficit would be smaller than otherwise.

The size of reduction need not be 100% and the period of suspension need not be one year. They can be “calibrated to meet the objectives of bringing down inflation”, subject to a review after three months.

— The author is a Honorary Adjunct Professor, Amrita School of Business, Bengaluru Campus. He was an International Visiting Professor, IIM Trichy, International Week, 2019 and Jan 2020.

Add new comment