National currency in global economy is like a stock in the stock exchange. Weak currency implies weak fundamentals, misallocation of capital and inefficient economy, conversely strong currency implies strong competitive economy and efficient allocator of capital. 60 Years of socialist governments have managed to make sure Indian rupee gets more and more worthless each passing year. It is not preordained law in the universe that rupee has to perpetually fall forever into worthlessness. Exact opposite is true, strong currency fosters middle class, forces businesses to get more efficient, preserves purchasing power, promotes thrift and above all fosters more efficient use of capital and resources. In addition a good currency lowers the cost of capital allowing businesses to compete in global markets. RBI is managing the INR with outdated guidelines and buying foreign currency (USD, GBP etc) like they have some perpetual value. These foreign currencies are not the hard money of 1950’or 60’s. They have little backing of gold and not anchored with anything of value and most of the western nations have terrible balance sheets and ballooning debts (as you will see in the tables below). Why are we accumulating such reserves? A large portion of reserves should in real assets like Gold, which has preserved purchasing power for 1000’s of years like no other asset class? Gold is one of the most liquid assets in the planet.

One of the reasons for excessive reserve accumulation are high interest rates in India (which again is due to legacy issues), which is resulting in massive capital arbitrage via corporate borrowings and debt inflows; if interest rates drop then capital flows will slow down. Interest rates should be set by market and India Rupee should float in the markets with no capital controls. You don’t then need these huge and growing reserves. If rupee appreciates, interest rates go down and vice versa. Instead of buying reserves, we manage the economy by interest rates and credit controls. Australia, Canada, Switzerland, which are barely 25-40% of our GDP don’t have capital controls and have free floating currencies and why not India. Author believes Indian economy is rapidly becoming more competitive and it is not necessary to endlessly depreciate Rupee, accumulate huge reserves. Author also believes that Indian Rupee is a better currency than most of so called “hard money” like Dollar, Euro and Pound. India needs a quick road map to a free floating currency.

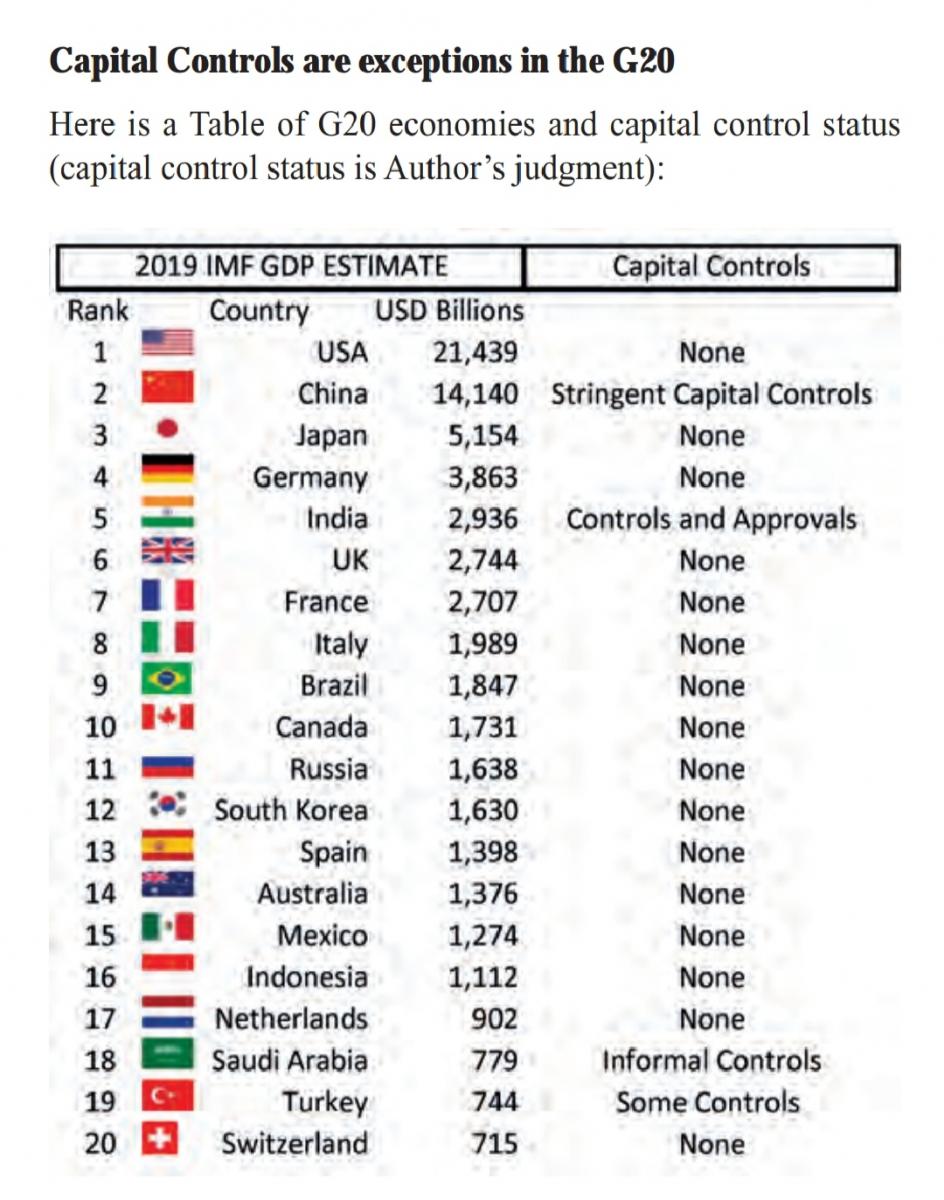

If you look at this list, only China and India have significant controls on capital account. China has very large M2 money supply vs. their GDP, and to maintain control of domestic monetary policy, they have stringent controls on capital account. China’s total outstanding bank credit to Forex reserves is over 13 implying that if just 1 of 13 Yuan decides to leave China, they will lose all their reserves (assuming nothing else changes). Similar number for India is less than 5. This means if 1 out of 5 rupees decide to leave India, India will lose all reserves. India is in far stronger position than economic planners believe it to be.

Current flawed logic of capital controls & depreciating rupee:

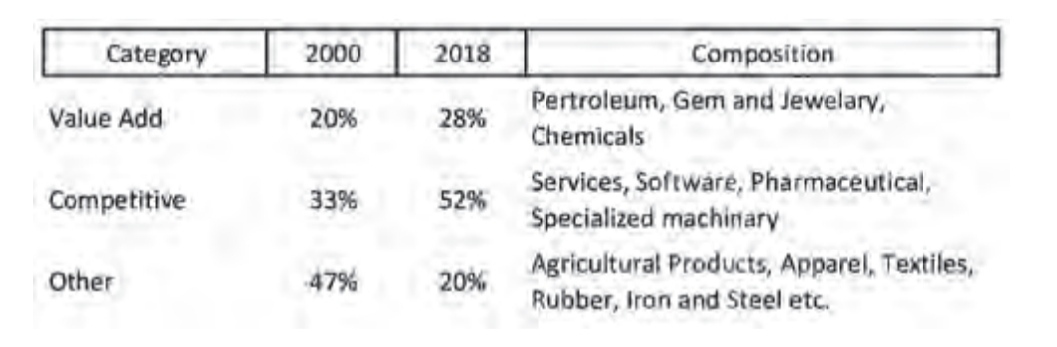

First: We are a developing country, like all developing countries we should have capital controls and competitively depreciate our currency to stay competitive. “Devaluation to increase Exports” logic is not based on evolving competitiveness of Indian economy. In 2000 India’s export basket consisted primarily of commodity and low value add products. Goods and services where we had a competitive advantage were at 33%, where our competitiveness was heavily dependent on exchange rate was 47%. Same numbers in 2018 are 52% (Competitive) and only 20% where exchange rate devaluation might help. Those numbers where exchange rate devaluation may boost competitiveness I suspect in 2020 are even lower and closer to 18%. So for export competitiveness of 18%, we continue to devalue rupee and deprive the economy of free and open capital account and free market advantages that all the mature economies enjoy. I suspect the disadvantage that free exchange rate might create to trade is vastly offset by the free market benefits to the rest of the economy. Author believes lowered capital costs as a result of freedom of capital movement, actually will boost competitiveness of large segments of Indian Economy (more below).

It is a well known fact that we are unable to export a large segment of our products where countries are using qualitative barriers to their imports. We are a global leader in Milk Production, yet 9 of the top 10 markets we can’t export any milk products. You can devalue all you want; you can’t export milk and similarly many other products to those countries. Similarly our ally Japan had qualitative restrictions on our apparel. Similar story is repeated across many products where other countries prohibiting our access to their markets. Exchange rate will not help there. India’s trade negotiators need to review all trade agreements to see what is preventing those exports. In addition many areas we have large competitive advantages, only some efforts are being made to promote exports. e.g. railway equipment, defense equipment, infrastructure projects etc. We are producing lowest cost nuclear power reactors in the world, but there is zero effort to export it anywhere. Our goods trade deficit is primarily from China and ASEAN. Both are being heavily mercantilist and restrict Indian imports through all sorts of means and dumping products in Indian markets. It is repeated across range of products and range of markets. How does devaluation help here? It does not. Indian Trade Representatives need a new refresher course to get trade policy working for Indian economy. It is not an exchange rate problem.

Second Big reason is capital outflows might overwhelm the economy. I highly doubt it. We are actually being overwhelmed by capital inflows due to huge interest rate arbitrage and very attractive investment climate. India has an economy that has been in top 3 in attracting FDI for past many years and now Number 1, why would net capital flow out when the investment climate is one of the best in the world and getting even better. Even if some capital flows out, it likely is for good reason; I would say far more capital is likely to flow in, since the open capital markets will not preventing outflow.

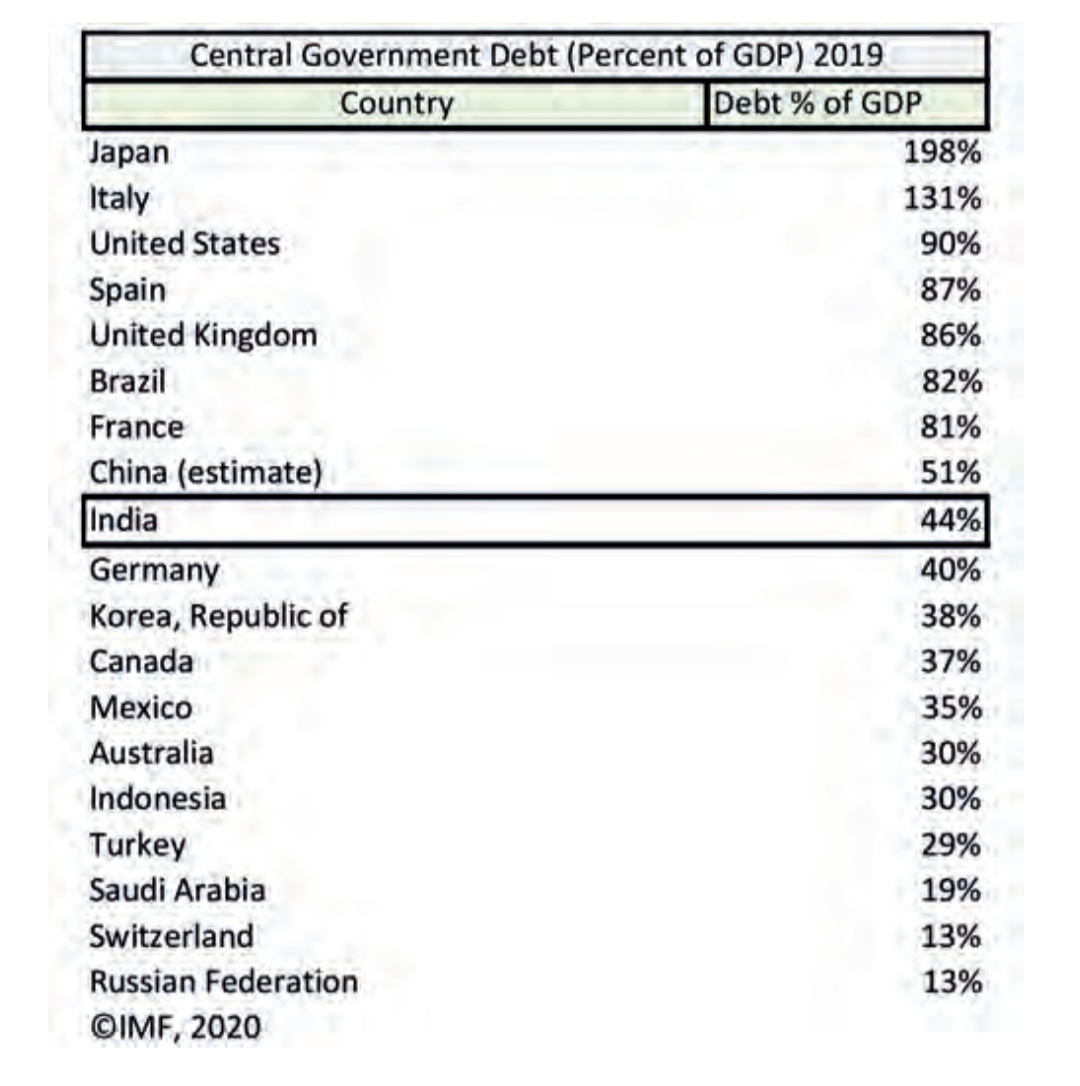

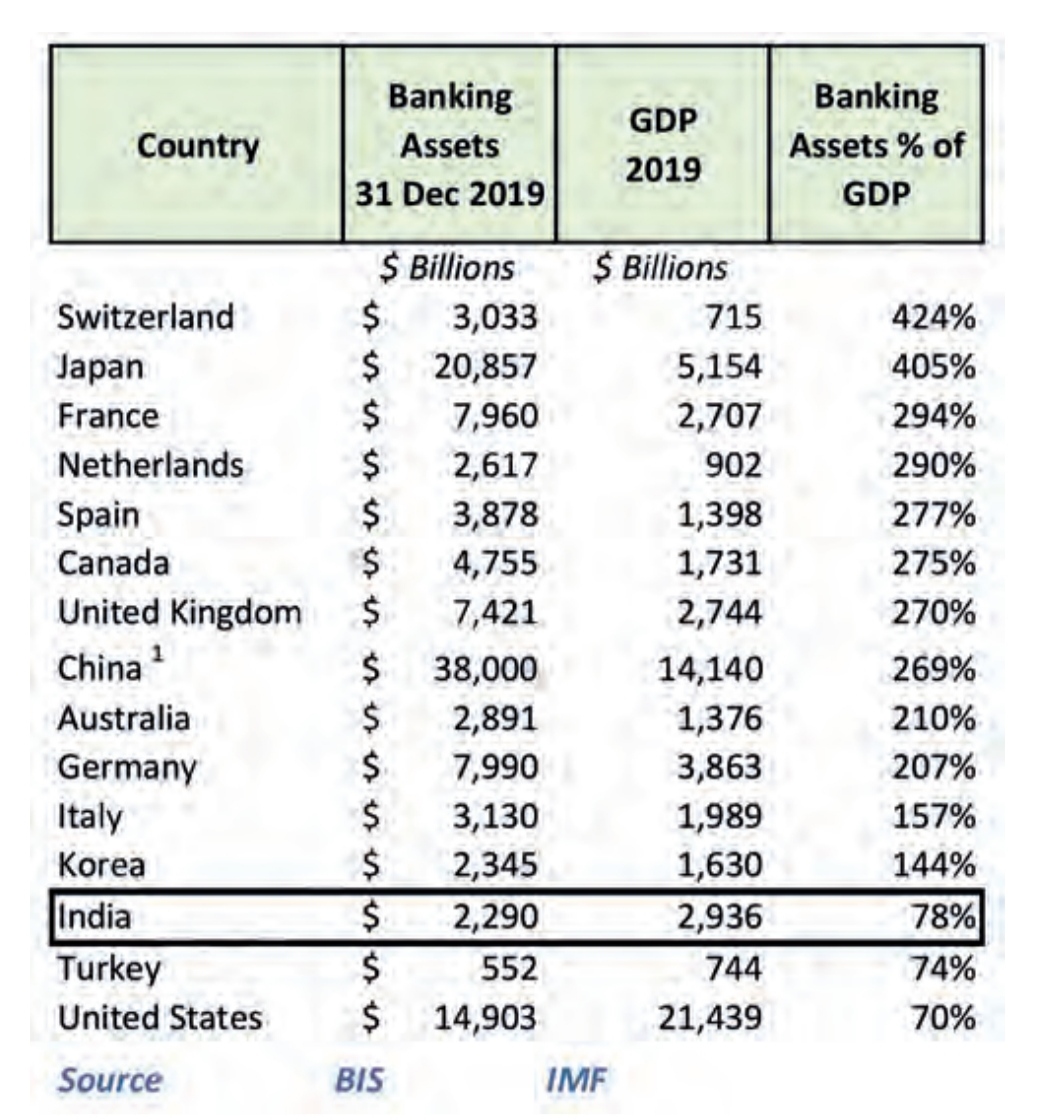

India’s balance sheet is far stronger then G7 and is at par with Germany in government debt. At Central level it is below 50%. Banking as a % of national GDP is barely 75%, which is also one of the smallest in the world. India has deleveraged over the past 5 years and balance sheet is excellent and competitive compared to most of G20.

In 2020 and 2021 USA and UK are running a budget deficit of 15-20% of GDP, therefore these numbers are even worse than the chart above. United States is going to run a budget deficit of $4 trillion on top of $3 trillion last year. Do you really think with those numbers US$ is really a store of value?

Banking being an extension of national government balance sheet, because of implicit bail out possibilities, it matters a great deal, how big is the banking sector. This is to have an idea how much of these liabilities can affect sovereign credit. Witness Ireland and Spain where bloated banking systems brought down sovereign credit. Indian economy is far less levered than many of the G20 Peers.

Due to low leverage in the economy, very unlikely much capital is going to flow out. India is the 5th largest economy but 15th largest banking system.

Third: Illicit flows, they are happening any way, there are all sorts of financial processes and intelligence and data gathering in place already. All we need to do is to enhance them and make them more robust. Business and free market efficiency benefits far outweigh any such control benefit.

Banks are the conduit, we can easily put level 1, 2, 3 controls which progressively require more data, like tax returns and personal profiles for transfers and banks should have clear guidelines to receive and send money outside the sovereign system.

Fourth So called global “economic experts” are generally biased against India, also including many India based experts. They want to keep India down and under their thumb. Listen to nationalist voices, expertise is secondary to motivation and intent.

Damage by not allowing free market to operate

Weak currency is weak, due to bad economic policies, and strong currency is strong due to good economic policies. Currently India has currently the best set of economic policies since 1947, a nationalist government is at the center and doing a decent job, deleveraging and allowing free market to allocate resources, vs. corruption driven bank loans in previous dispensation. INR should appreciate (and/or interest rates to go down) under such circumstances. But unfortunately RBI is guided by previous socialist guidelines and not allowing that to happen. Similarly by not having convertibility, India has in past repeatedly run down forex reserves to hide the incompetence of many past governments. By keeping exchange rate somewhat managed, is giving tool to a future incompetent government which democracy inevitably will throw at the country and allowing them to run havoc, since exchange rate is managed, citizens won’t know the consequences of their poor polices for up to a decade sometimes.

Patnaik and Shah 2012 published a study and came to the same conclusion that controls are harming the economy in significant ways, some of them are (as per that study) 1) Reduced Financial Integration with global economy and 2) Micro Economic distortions in decisions of economic agents. 3) Price differences between foreign and domestic capital markets. (Above is paraphrased to keep it short)

There are benefits of capital controls as you get control of your domestic monetary policy. But we are getting massive debt inflows that negate all those benefits. So we have the worst of both worlds by continuing the controls. Net costs of capital controls have only grown in the last 8 years, while Indian economy has almost doubled in size.

India is attracting record Capital Inflows

India is likely getting over $60-100 Billion (authors estimate) in capital inflows in debt, FDI and Equity. This has to be one of the highest inflows (@ est. 3% of GDP) by any major country. This only leads to strong currency and/or lower interest rates, even unthinkable negative interest rates in order to curb the strength of INR. Currently the strength is hidden in accumulation of record currency horde. But moment RBI stops buying USD, INR will strongly appreciate and/or interest rates will dive. Hence to stop appreciation both INR appreciation and lower interest rates are inevitable. For years capital market was closed due to fear that capital will flow out. If capital account was open then interest rates will go sky high. So to keep monetary policy independence, capital controls are imposed. Now the situation is reverse. Capital is getting attracted due to very strong economic performance and great country balance sheet. So we have no choice but import global monetary policy or risk getting reserves at extraordinary levels, with potential to even touch a $1 Trillion and more in 2-3 years. Better to have lower interest rates, open capital account and stop excessive reserves coming in. For years currency depreciation has provided RBI with gains, I fear now stronger Rupee will create losses for RBI. We have a serious balance sheet threat to RBI by holding these so called “Hard Currencies”. In effect RBI is subsidizing corporate India’s borrowing abroad. Temporarily there could be a tax on domestic companies borrowing abroad to pay for RBI reserves carry. Once interest rates normalize, then inflows will stop and tax can be removed.

Objective should be Strong Rupee

Strong currency builds purchasing power of middle class and it is democratic transmission method of sound economic policies. If for whatever reason Rupee does depreciate (in author’s opinion is highly unlikely) then government needs to do even better job than it is doing currently. Trade policy changes to open foreign markets in products and services where India is highly competitive and restricting dumping of below cost labor intensive products would swing trade balance by $100+ billion at least. Why should RBI allow hiding of any poor performance or similarly benefit of good performance by continuing the managed currency policy.

Efficient capital markets resulting from free floating currency will make Indian companies far more competitive

When Indian companies are competing with the rest of the world, they need capital at similar cost as rest of the world. India’s debt markets are vastly underdeveloped vs its equity markets. Some industries like Steel, Aluminum, Chip making, Shipping and many others are very capital intensive. These industries have a difficult time competing with high capital costs and in some cases twice as high as their competition. A free capital account and floating currency will allow capital markets to realign competitively and allow India’s competitive advantages to come to fore. Any so called “loss of exports” will be more than made up by competitive rise in other industries. Author believes continuous devaluation only yields inefficiencies and continuous third world status. Strengthening currency (result of sound economic policies) is net benefit to the economy by promoting efficiencies, lower inflation and rise of purchasing power of Indian consumer. It is the only way to be a developed economy. Only two countries in the G20 are using significant capital controls. China is not an example for India as it is not a market economy by most standards, but the rest of the world is.

Forex Reserves are no more hard currency than Indian Rupee

It is authors contention that Indian rupee is a better store of value than British Pound, Euro and US dollar. India’s balance sheet is better or same vs. any of the currencies that we are competing with. Western governments are piling up massive budget deficits and future currency devaluation in real terms is almost certain. It is inevitable inflation will follow. As India is becoming more and more competitive, we need to let currency appreciate and its value determined by market vs. managed float. This way we can save our middle class and Indian economy from ravages of coming inevitable global inflation very much like Swiss were relatively inflation free in 70’s as Swiss Franc appreciated continuously.

Free Convertible Currency is massive political power

This is very evident from global economic ecosystem. Just one look at smaller countries with free floating currencies, they carry far more clout than one with closed capital accounts. India will soon be a $5 Trillion economy on its way to $10 trillion. Not many people remember, but until 60’s Indian rupee was the money used in Middle East gulf countries. Closed system will not foster this fast rise. Indian entrepreneurs, professional classes are fully capable of competing with rest of the world and show its true power. In addition India’s financial centers will participate in global financial markets just like Hong Kong, London, New York and Singapore do. It is essential that India participate in global capital allocation process, India is a heavy weight even today, and is being held back by policies that are more fit for the 90’s vs today’s software and pharma superpower.

Those who disagree and say we need controls should answer a simple question, when should this be done? If never, then we will have massive distortions in the system which will be hard to fix as reserves balance sheet of RBI balloons further closer to a $1 Trillion.

If we want to have reserves, have lot more gold. That is real money.

“Gold is money. Everything else is credit.” J.P. Morgan in his testimony before Congress in 1912

India has one of the lowest gold reserves of any major nation. Proper course is to have large gold reserve. India should have 50% of reserves in Gold and in its own vaults vs. in London.

Need to think like a winner

India needs a winning mindset and bigger dreams. Already India’s talents are respected around the world, but its closed capital account is significantly slowing down global aspirations. Indian companies are strong, competitive, and ready for the world. Opening capital account is essential as businesses to think globally, have globally competitive capital costs and produce globally competitive products. It will give us a leg up on neighbor to the north, where in spite of second largest economy capital account is closed.

In author’s opinion, Indian rupee will actually rise if authorities let it and don’t believe exports will be significantly affected unless we see a sudden jump of 10-25% in value.

Replace Active intervention with Macro Prudential Monetary management

Country should make macroeconomic policies that favor strong currency and lower interest rates,

Last time India was losing reserves, credit was growing in double digits. Bottom-line is that, you don’t need heavy handed capital controls if domestic credit creation is disciplined and stays at good macro prudential norms. In India bank assets are 78% of GDP, which is very healthy. Similar number in China is over 250% (exact numbers are hard to determine). It is the excessive internal liquidity that creates outflow risks, and if internal liquidity is within macro prudential norms, the foreign exchange value will be stable or appreciating as all strong economies do over a period of time.

One of the successes of East Asian economies was directing savings towards investment vs. consumer borrowings. India is not properly channeling its savings as a significant part of bank advances are stuck in consumption financing, which includes Autos, luxury housing, credit cards etc. In fact consumption borrowings should have large tax like 4% to be collected by banks, so cheaper capital can be channeled to infrastructure and capital intensive industries where low cost capital is one of the keys to competitive positioning.

Steps

It is critical that an immediate road map be developed and framework be put in place to free up the capital account. It likely means reform of banking and credit markets as well. But it must be done and time is now. We also need to make sure we DON’T cause excessive debt build up and re-leveraging due to lowered interest rates and potential misallocation of capital resulting from it.

We need to open capital account in steps over 2-3 years and not a big bang so policies across credit and banking can be in place for full convertibility.

These are just a few ideas and a national discussion is needed.

First Put breaks on debt inflows to stop excessive reserve build ups, likely through a tax, so while we are opening up capital accounts, we temporarily discourage heavy debt arbitrage flows by corporate India and global debt funds buying up our debt. This tax money can be used by RBI to deal with losses from depreciation of its reserves in INR as rupee appreciates.

Second Put regulations for opening up capital outflows in stages so it is not very disruptive and also illicit black money does not get to move out of country.

Third Convert at least a 1/3 or more of reserves into Gold. Don’t listen to so called economists who have been bred in Keynesian theory. Gold has value now and forever. Every single paper money has gone worthless in the history. $, pound and Euro are paper monies with no intrinsic value. Indian Rupee needs to real asset like Gold to deal with oncoming global economic and monetary crises.

Fourth Make sure controls are in place to keep a check on bank balance sheets and credit growth. Growth of balance sheet greater than economic growth is what will lead to a future crisis. Banks should be run prudently and conservatively, let capital markets take the risks and allocate risk capital.

Conclusion:

This article is written to start a dialogue and a discussion. Solutions need to be vetted and are not set in stone. All critics need to be aware that discussions start with bold ideas that need to be challenged, refined and then implemented.

Have big and bold objectives to be a top performing free market economy and one of the centers of global capital markets and act on them. These steps will be a strong indication that India has arrived and is positioned as a global economic superpower.

Add new comment